In this tutorial, we will learn how to

- Download and save stock time-series in Pandas and Python.

- Compute a simple moving average of time series by writing a “for” loop.

- Compute a simple moving average of time series using Panda’s rolling() function.

The GitHub page with the codes used in this and in previous tutorials can be found here. The video accompanying this post is given below.

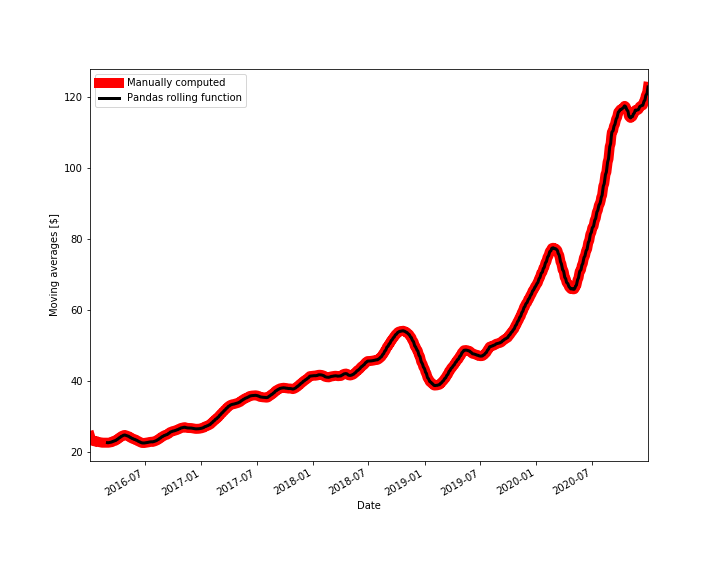

Let us first, explain what is a moving average. Let ![]() be a time series (the notation

be a time series (the notation ![]() denotes a set of discrete-time samples

denotes a set of discrete-time samples ![]() of the variable

of the variable ![]() ). Then a simple moving average of the time series

). Then a simple moving average of the time series ![]() is defined as follows

is defined as follows

(1)

where ![]() is a new time series obtained from the time series

is a new time series obtained from the time series ![]() . The positive integer

. The positive integer ![]() is called the moving horizon window or the past window. So basically, at the discrete-time instant

is called the moving horizon window or the past window. So basically, at the discrete-time instant ![]() , the simple moving average is computed by averaging the last

, the simple moving average is computed by averaging the last ![]() samples of

samples of ![]() (including the current sample). The main question is what happens at the time instant

(including the current sample). The main question is what happens at the time instant ![]() , since we usually do not have access to the values of

, since we usually do not have access to the values of ![]() for negative

for negative ![]() . One approach is to simply initialize the values of

. One approach is to simply initialize the values of ![]() to be zero for

to be zero for ![]() . Another approach is to start the computation at

. Another approach is to start the computation at ![]() .

.

Let us see now how to compute the simple moving average in Python. First we are going to import all the necessary libraries and we are going to download and save Apple stock data to our local computer.

# -*- coding: utf-8 -*-

"""

Moving average of stock prices

Author:

Aleksandar Haber

Date: January 21, 2021

Some parts of this code are inspired by the codes given in

"Learn Algorithmic Trading: Build and deploy algorithmic trading systems and strategies

using Python and advanced data analysis"

by Sebastien Donadio and Sourav Ghosh

"""

# simple moving average implementation in Python and comparison with Pandas

# standard imports

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

# used to donwload the stock prices

import pandas_datareader as pdr

#necessary for computing averages

import statistics as stats

# define the parameters

moving_average_window=40

# define the dates for downloading the data

startDate= '2016-01-01 '

endDate= '2021-01-01'

# Read about Python pickle file format: https://www.datacamp.com/community/tutorials/pickle-python-tutorial

fileName = 'downloadedData.pkl'

stock_symbol='AAPL'

# this piece of code either reads the data from the saved file or if the saved file does not exist

# it downloads the data

try:

data=pd.read_pickle(fileName)

print('Loading the data from the local disk.')

except FileNotFoundError:

print('The data is not found on the local disk.')

print('Downloading the data from Yahoo.')

data = pdr.get_data_yahoo(stock_symbol,start=startDate,end=endDate)

# save the data to file

print('Saving the data to the local disk.')

data.to_pickle(fileName)

A few comments about this code are in order. The code line 27 is used to define the moving horizon window. The code lines 32 and 33 are used to define the start and end dates for downloading the stock data. The code line 38 is used to define the stock symbol. In our case, the stock symbol of Apple is “APPL”. Every company that has a corresponding stock has a unique symbol on the stock market exchange. The code lines 43-52 are used to download the stock data and to save it to the local computer. We use an “exception handling” approach in order to increase the code robustness. Under the “try:” code block, we first try to read the data from the local computer. If this code block throws an exception, then the data does not exist on the local computer and the code block under “except FileNotFoundError:” is executed. This code block downloads the data from the Internet using the Pandas function “get_data_yahoo()”.

The following code lines are used to inspect the data and to isolate the time series of “adjusted close prices” that are denoted by the string “Adj Close”.

# inspect the data

data.head()

data['Adj Close'].plot()

# isolate the closing price

closingPrice = data['Adj Close']

# isolate the values

closingPrice.values

The code line 9 is used to define the Pandas time series object “closingPrice” that contains the adjusted closing prices. This object will be used to compute the moving average. We explain this in the sequel. The following code lines are used to manually compute the moving average

# computed moving averages

computedMovingAverages=[]

batch=[]

for price in closingPrice.values:

batch.append(price)

# if the number of stored entries is larger than the batch capacity, erase the

# first entry

if len(batch) > moving_average_window:

del(batch[0])

computedMovingAverages.append(stats.mean(batch))

# append the original data frame with the computed moving average

# that is, add a column that will contain the values of the computed moving averages

data=data.assign(Moving_average=pd.Series(computedMovingAverages,index=data.index))

A few comments are in order. The variable “computedMovingAverages” is used to store the computed moving averages, and the variable “batch” is used to store the values of past “moving_average_window” samples of the time series. At the end of the computations, we define another column of the “data” Pandas DataFrame object to store the computed moving averages. The following code lines plot the stock prices and moving averages.

fig1=plt.figure(figsize=(10,8))

ax1=fig1.add_subplot(111,ylabel='Stock price in dollars')

data['Adj Close'].plot(ax=ax1, color='b', lw=3, legend=True)

data['Moving_average'].plot(ax=ax1, color='r', lw=3, legend=True )

plt.savefig('moving_average.png')

plt.show()

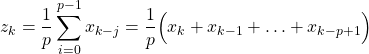

The results are given in the figure below.

The blue line in Fig. 1 represents the stock price and the red line represents the computed moving average. Next, it is important that we compare our computations with the built-in Pandas functions for computing the moving averages. The following code lines are used to compute the moving average using the built-in Pandas function “rolling()” and to compare the results with manually computed moving averages. The code is given below.

#check the result using the Pandas rolling() function

moving_average_pandas=data['Adj Close'].rolling(window=moving_average_window).mean()

moving_average_pandas

data['Moving_average']

#compare the results

fig2=plt.figure(figsize=(10,8))

ax2=fig2.add_subplot(111,ylabel='Moving averages [$]')

data['Moving_average'].plot(ax=ax2, color='r', lw=10, label='Manually computed', legend = True )

moving_average_pandas.plot(ax=ax2, color='k', lw=3, label='Pandas rolling function', legend = True)

plt.show()

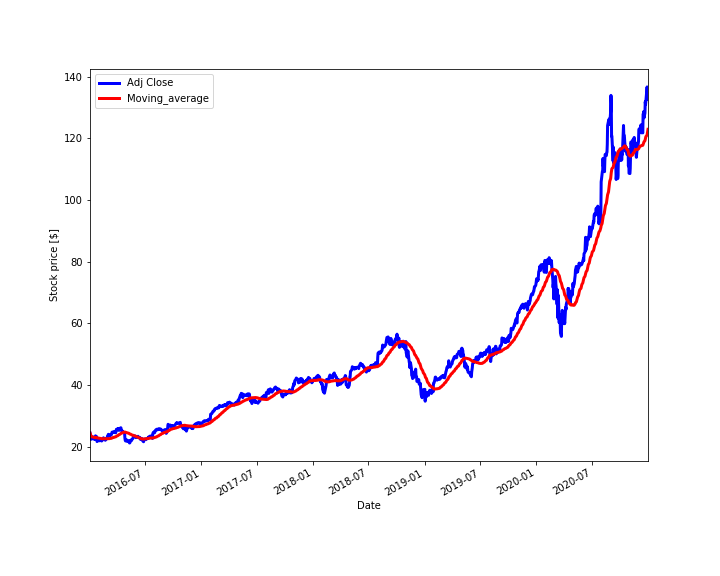

The figure below shows the comparison results.

From Fig. 2, we can observe that our results match the results produced by the built-in Pandas function, except for the initial 40 values. This is because the Panda’s rolling() function ignores the values of the time series for the time samples that are smaller than the specified moving horizon window.

This is the end of this post. We learned how to compute and plot moving averages of stock prices in Python.