This is the third post in a series of posts on time series modeling and analysis in Python. In this post, we will learn how to download and analyze financial (stock) time series. We will directly load financial time series data into a Pandas DataFrame structure. Consequently, we will be able to fully exploit the power of Pandas and Python to manipulate the downloaded data. The GitHub page with the codes used in this and in previous tutorials can be found here. The video accompanying this post is given below.

First, we import all the necessary libraries.

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import datetime #necessary for creating a datetime object

import pandas_datareader as pdr #necessary for downloading the stock data from Yahoo! Finance

# you need to install this library by opening a command line and by typing "pip install pandas-datareader"

The code lines 1-3 are used to import Pandas, Numpy, and plotting libraries. The code line 5 is used to import a library for defining a “datetime” object. This object is provided as an argument to a function for downloading the financial data. The code line 6 is used to import Pandas “datareader” library that is used to download the financial time series. Before you can import this library you have to install it by opening a command-line editor and by typing: “pip install pandas-datareader”.

The following code lines are used to download the historical stock data of Amazon and Boeing companies.

# load the stock data from internet

start_time=datetime.datetime(2020,1,1)

end_time=datetime.datetime(2021,1,1)

# load the Amazon stock data

amzn=pdr.get_data_yahoo('AMZN', start=start_time, end=end_time)

# load the Boeing stock data

ba=pdr.get_data_yahoo('BA', start=start_time, end=end_time)

The code lines 3 and 4 are used to define the start and end time stamps for obtaining the historical data. The code lines 7 and 10 are used to download the time series and to store them in DataFrame objects “amzn” and “ba”. The previous code lines can be compressed as follows.

# another way for defining the time stamps - using the pd.Timestamp() function

amzn2=pdr.get_data_yahoo('AMZN', pd.Timestamp('2020,01,01'), pd.Timestamp('2021,01,01'))

ba2=pdr.get_data_yahoo('BA', pd.Timestamp('2020,01,01'), pd.Timestamp('2021,01,01'))

We have used “pd.Timestamp(‘.’)” function to provide start and end time stamps.

Next, we explore the downloaded data. By executing the following code line

# investigate the data

amzn.head()

we obtain

High Low ... Volume Adj Close

Date ...

2020-01-02 1898.010010 1864.150024 ... 4029000 1898.010010

2020-01-03 1886.199951 1864.500000 ... 3764400 1874.969971

2020-01-06 1903.689941 1860.000000 ... 4061800 1902.880005

2020-01-07 1913.890015 1892.040039 ... 4044900 1906.859985

2020-01-08 1911.000000 1886.439941 ... 3508000 1891.969971

[5 rows x 6 columns]The indices can be obtained as follows

# get the index timestamps

amzn.index

DatetimeIndex(['2020-01-02', '2020-01-03', '2020-01-06', '2020-01-07',

'2020-01-08', '2020-01-09', '2020-01-10', '2020-01-13',

'2020-01-14', '2020-01-15',

...

'2020-12-17', '2020-12-18', '2020-12-21', '2020-12-22',

'2020-12-23', '2020-12-24', '2020-12-28', '2020-12-29',

'2020-12-30', '2020-12-31'],

dtype='datetime64[ns]', name='Date', length=253, freq=None)The column names can be obtained by executing

# get the column names

amzn.columns

Index(['High', 'Low', 'Open', 'Close', 'Volume', 'Adj Close'], dtype='object')The stored values can be obtained by executing

amzn_values=amzn.values

array([[1.89801001e+03, 1.86415002e+03, 1.87500000e+03, 1.89801001e+03,

4.02900000e+06, 1.89801001e+03],

[1.88619995e+03, 1.86450000e+03, 1.86450000e+03, 1.87496997e+03,

3.76440000e+06, 1.87496997e+03],

[1.90368994e+03, 1.86000000e+03, 1.86000000e+03, 1.90288000e+03,

4.06180000e+06, 1.90288000e+03],

...,

[3.35064990e+03, 3.28121997e+03, 3.30993994e+03, 3.32200000e+03,

4.87290000e+06, 3.32200000e+03],

[3.34210010e+03, 3.28246997e+03, 3.34100000e+03, 3.28585010e+03,

3.20930000e+06, 3.28585010e+03],

[3.28291992e+03, 3.24119995e+03, 3.27500000e+03, 3.25692993e+03,

2.95410000e+06, 3.25692993e+03]])The first three stored (row) values can be accessed as follows

# plot the values at the rows 1,2,3

amzn.values[0:3,:]

array([[1.89801001e+03, 1.86415002e+03, 1.87500000e+03, 1.89801001e+03,

4.02900000e+06, 1.89801001e+03],

[1.88619995e+03, 1.86450000e+03, 1.86450000e+03, 1.87496997e+03,

3.76440000e+06, 1.87496997e+03],

[1.90368994e+03, 1.86000000e+03, 1.86000000e+03, 1.90288000e+03,

4.06180000e+06, 1.90288000e+03]])Basic statistics can be computed by executing

# compute basic statistics

amzn.describe()

High Low ... Volume Adj Close

count 253.000000 253.000000 ... 2.530000e+02 253.000000

mean 2716.941377 2642.261857 ... 4.931556e+06 2680.855096

std 554.291416 539.598841 ... 1.976104e+06 545.761043

min 1759.449951 1626.030029 ... 1.451900e+06 1676.609985

25% 2166.070068 2124.110107 ... 3.476400e+06 2149.870117

50% 2955.560059 2871.000000 ... 4.526600e+06 2890.300049

75% 3202.000000 3130.489990 ... 5.789300e+06 3165.120117

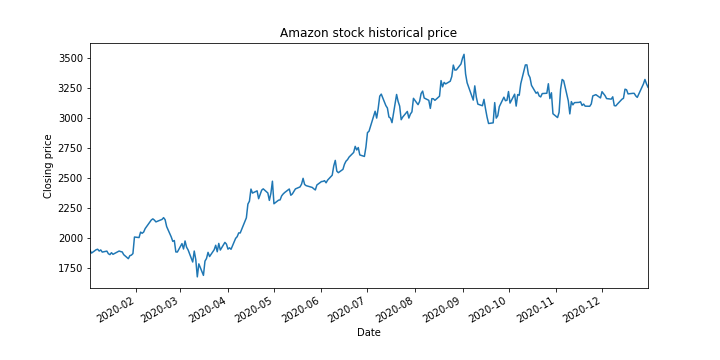

max 3552.250000 3486.689941 ... 1.556730e+07 3531.449951The column “Adj close” represent adjusted closing prices of stocks. The values stored in this column can be plotted as follows.

#plot the closing prices

ax1=amzn['Adj Close'].plot(figsize=(10,5),title='Amazon stock historical price')

ax1.set_xlabel('Date')

ax1.set_ylabel('Closing price')

# save the figure to a file

plt.savefig('amzn.png')

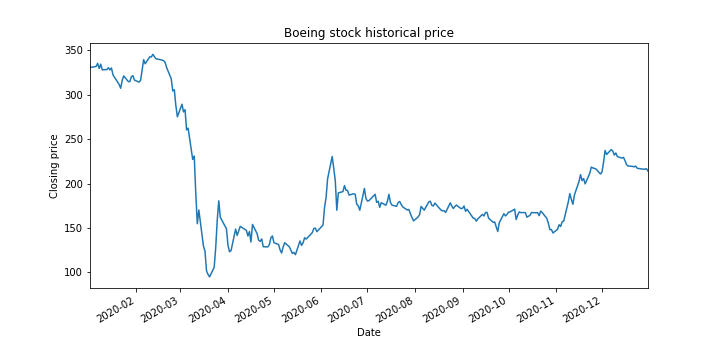

#plot the closing prices

ax2=ba['Adj Close'].plot(figsize=(10,5),title='Boeing stock historical price')

ax2.set_xlabel('Date')

ax2.set_ylabel('Closing price')

# save the figure to a file

plt.savefig('ba2.png')

Once we have downloaded the data, it is a good idea to save the data to a file. The following code lines save the downloaded time series to a file, load the saved data into a new variable, and plot the time series.

# save data to a file

amzn.to_csv('amzn_data.csv')

# load data from the saved file

loaded_amzn=pd.read_csv('amzn_data.csv')

loaded_amzn['Adj Close'].plot(figsize=(10,5))

The monthly means can be computed as follows

# resample the data

monthly_resampled_amzn=amzn['Adj Close'].resample('M').mean()

monthly_resampled_amzn

monthly_resampled_amzn.plot()

The difference between the open and closing prices can be computed as follows

# add a new column to data that is difference

amzn['diff']=amzn['Open']-amzn['Close']

amzn.columns

amzn.head()

amzn['diff'].plot()

Notice that we have added a new column to the DataFrame structure that represents the computed difference. This column can be erased as follows

# delete a column

del amzn['diff']

amzn.columns

The adjusted closing prices of Amazon and Boeing stocks can be concatenated as follows

#concatenate

#concatenate

close_amzn=amzn['Adj Close']

close_ba=ba['Adj Close']

close_concat=pd.concat([close_amzn,close_ba],axis=1)

close_concat.head()

close_concat.columns

Adj Close Adj Close

Date

2020-01-02 1898.010010 331.348572

2020-01-03 1874.969971 330.791901

2020-01-06 1902.880005 331.766083

2020-01-07 1906.859985 335.285156

2020-01-08 1891.969971 329.410095

Index(['Adj Close', 'Adj Close'], dtype='object')Two DataFrames can also be concatenated. This can be achieved by executing the following code lines

# concatenate everything

concat=pd.concat([amzn,ba], axis=1)

concat.head()

concat.columns

High Low ... Volume Adj Close

Date ...

2020-01-02 1898.010010 1864.150024 ... 4544400.0 331.348572

2020-01-03 1886.199951 1864.500000 ... 3875900.0 330.791901

2020-01-06 1903.689941 1860.000000 ... 5355000.0 331.766083

2020-01-07 1913.890015 1892.040039 ... 9898600.0 335.285156

2020-01-08 1911.000000 1886.439941 ... 8239200.0 329.410095

Index(['High', 'Low', 'Open', 'Close', 'Volume', 'Adj Close', 'High', 'Low',

'Open', 'Close', 'Volume', 'Adj Close'],

dtype='object')The data can be concatenated in a more elegant way. This can be achieved by assigning the keys, so we can easily retrieve the data.

# acessing the entries

concat2.head()

concat2['AMZN'].head()

concat2['AMZN']['Adj Close'].head()

concat2['AMZN']['Adj Close'].loc['2020-01-02']

AMZN ... BA

High Low ... Volume Adj Close

Date ...

2020-01-02 1898.010010 1864.150024 ... 4544400.0 331.348572

2020-01-03 1886.199951 1864.500000 ... 3875900.0 330.791901

2020-01-06 1903.689941 1860.000000 ... 5355000.0 331.766083

2020-01-07 1913.890015 1892.040039 ... 9898600.0 335.285156

2020-01-08 1911.000000 1886.439941 ... 8239200.0 329.410095

High Low ... Volume Adj Close

Date ...

2020-01-02 1898.010010 1864.150024 ... 4029000 1898.010010

2020-01-03 1886.199951 1864.500000 ... 3764400 1874.969971

2020-01-06 1903.689941 1860.000000 ... 4061800 1902.880005

2020-01-07 1913.890015 1892.040039 ... 4044900 1906.859985

2020-01-08 1911.000000 1886.439941 ... 3508000 1891.969971

concat2Date

2020-01-02 1898.010010

2020-01-03 1874.969971

2020-01-06 1902.880005

2020-01-07 1906.859985

2020-01-08 1891.969971

Name: Adj Close, dtype: float64

1898.010009765625